In our report Tech Impact ’19: How technology is used by the UK’s fastest growing businesses, we drilled into three of the technology categories that are used most by the fastest growing businesses compared to other businesses. At the top of the pile was the Business Intelligence (BI) and Data Visualisation category and, over the last two weeks, we’ve drilled into its channel partner and end-user markets.

Tucking in behind, was the Application Development & Management category – which comprises tools for application lifecycle management (ALM), design, construction, automated software quality and other application development purposes, as well as for maintaining, enhancing and managing applications. Our analysis found that New Relic, Atlassian, AngularJS, Jenkins and Telerik were the biggest players in the market.

Technology impact

What is notable about the technology in this category is that it was the only one of our featured three that showed negative growth among the Fast Track 100 businesses (the UK’s fastest growing businesses) that use it. In contrast, though, it showed the largest positive difference in most recent revenue for those same businesses compared to business that don’t use some form of tech from the category. It’s also notable that the Fast Track 100 businesses using Application Development & Management technology have on average 116 more employees than those that don’t – the largest difference of any of our featured categories.

What all this suggests is that, while Application Development & Management technology may not drive sales growth, it helps to consolidate high sales in post-growth businesses. These businesses are large enough to develop and manage applications themselves – either for internal use or commercial sale.

Sector insights

Using the IQBlade platform, we identified 926 channel companies flagged as having a competency in Application Development & Management – that is to say they either trade in the technology or are able to deliver functions using it, either as a commercial service or for internal purposes. Average revenues for last year came in at £92m, average profits at £51m (both up on the previous year) and number of employees at 104.

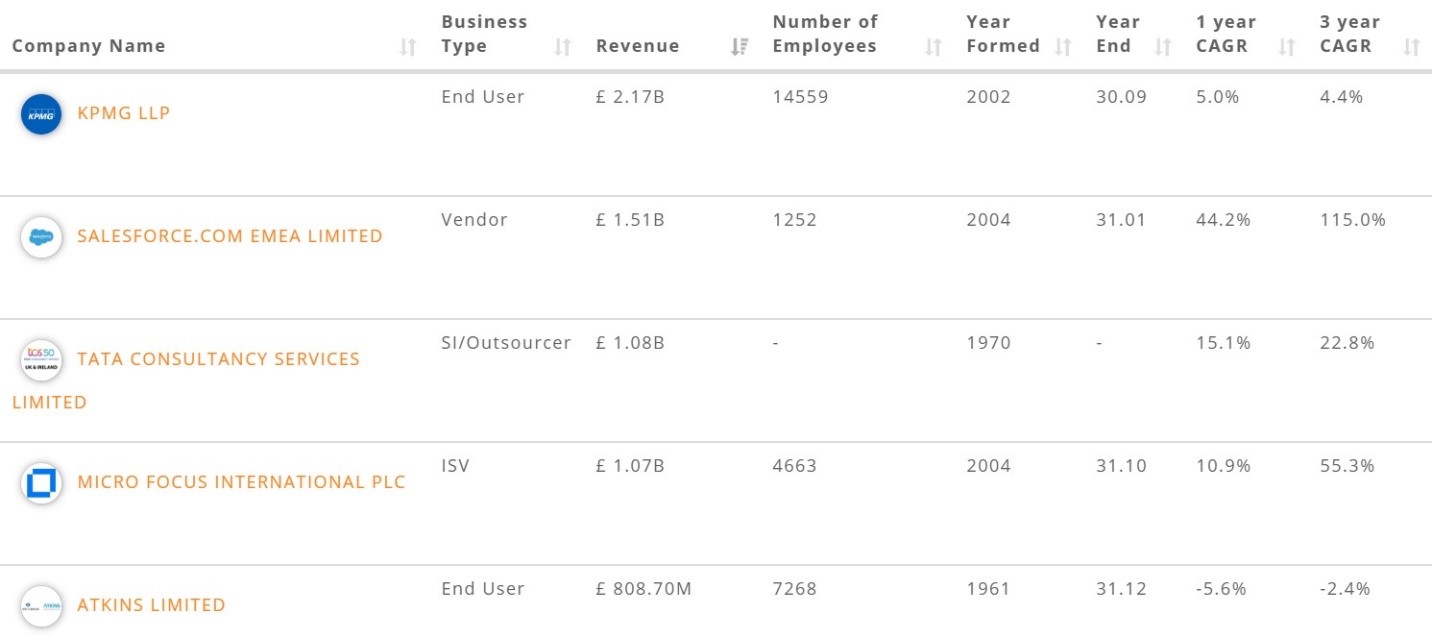

Looking at the top five sector businesses in terms of revenue, we can see a spread in business type. Notably, though, the biggest of the lot, KPMG, is an end-user. As a major professional services firm, this is not wholly surprisingly, as it will no doubt develop apps for use both internally and among its customers.

Two of the top five businesses in terms of three-year growth, meanwhile, are vendors and the list alsp includes Iwoca (a FinTech startup). Not only can we see strong growth from all five, but it is relatively even, whereas in some other sectors we see more dramatic differences between growth-rates at the top end.

Sector star

Most notable, of course, is the fact that Salesforce appears in both lists. Founded in 1999, the business has continued expanded its sales and marketing platform offering.

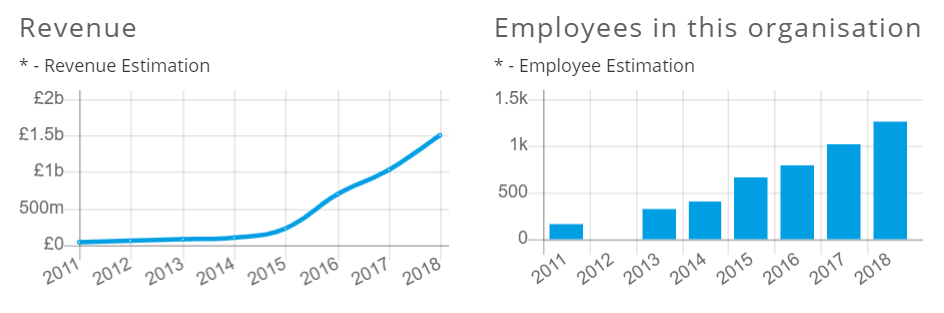

Delving into its EMEA company profile in the IQBlade platform we can see the sustained growth that its strategy has delivered.

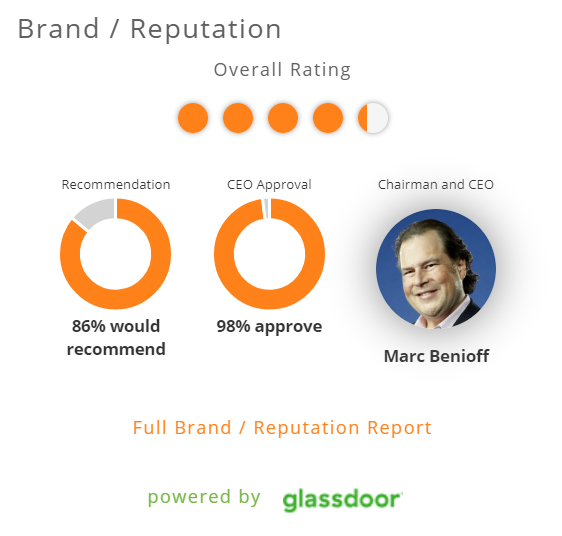

Perhaps most tellingly, though, is the feedback given by its employees. The company’s excellent approval rates as both a place of work and for its leader Marc Benioff provides the sort of strong culture that underpins high performing businesses.